Amalgamated Bank Online Account Opening

Amalgamated Bank Online Account Opening

Online Account Opening is typically an online customer’s first interaction with a bank, and a positive experience is critical to establishing and maintaining a relationship. If the Bank wanted its consumer business to remain competitive against encroaching disruption from fintech companies, streamlining the antiquated online account opening experience was critical.

ROLES: Research, UX Design, Prototyping

Research

Only 17% of applications started were approved; the remainder were incomplete or declined (often erroneously)

Of the applications that were approved, less than half funded and used their accounts

The average time to complete the process was 17 minutes

The Bank was losing money due to high fees charged per application

Technological solutions for online account opening were outdated and inefficient, contributing to high fraud losses and high per-application costs

Streamlining the Application: 17 minutes to

5 minutes

The Bank’s previous vendor offered few back-end validation systems, requiring the user to enter a substantial amount of information to meet strict regulatory requirements for ID verification

The new workflow would bring more accurate results using fewer inputs through third-party integrations

Integration with Quovo, an instant account verification platform, made it easier for customers to fund their accounts in-application

SERVICE DESIGN USE CASES

There are many actors and tools at play behind the scenes when a user opens a bank account

Use case diagrams (left) show what happens and how it affects the actors (rectangles) and systems (diamonds)

In this example, the user successfully opens an individual account, resulting in a cascade of actions throughout the bank’s ecosystem

A list of all possible scenarios (e.g., getting declined, flagged for fraud, entering email address incorrectly, etc.) was created and diagrams were constructed that detailed what would happen in each scenario

Optimizing User Experience

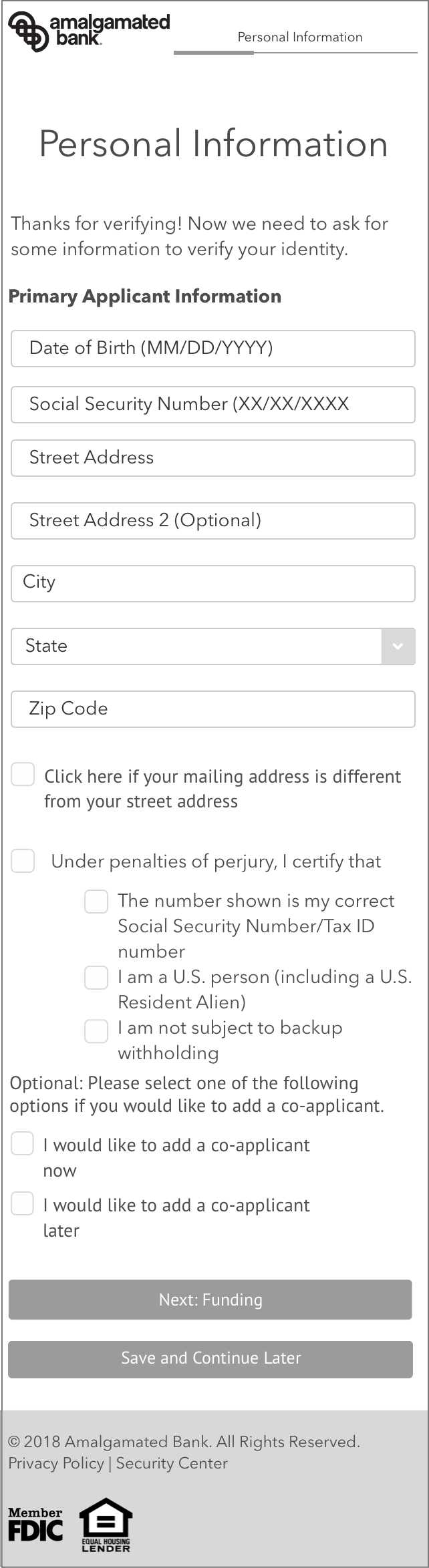

The voice of the existing user experience was formal and opaque. While some of the regulatory language could not be altered, greater transparency and a friendlier voice instilled a sense of trust

Only essential contact information was captured immediately for the purposes of following up if the customer left the application incomplete

Fields such as Employment, Transaction History, Citizenship, ID information, and Middle Name were stripped out, leaving only the fewest number of fields required by law

All attestations (Social Security Number/Tax ID Certification, US Person Certification, and Backup Withholding Certification) were grouped together under one click instead of requiring multiple clicks

Come Back Soon!

This project is still in progress, but a prototype will be coming soon!